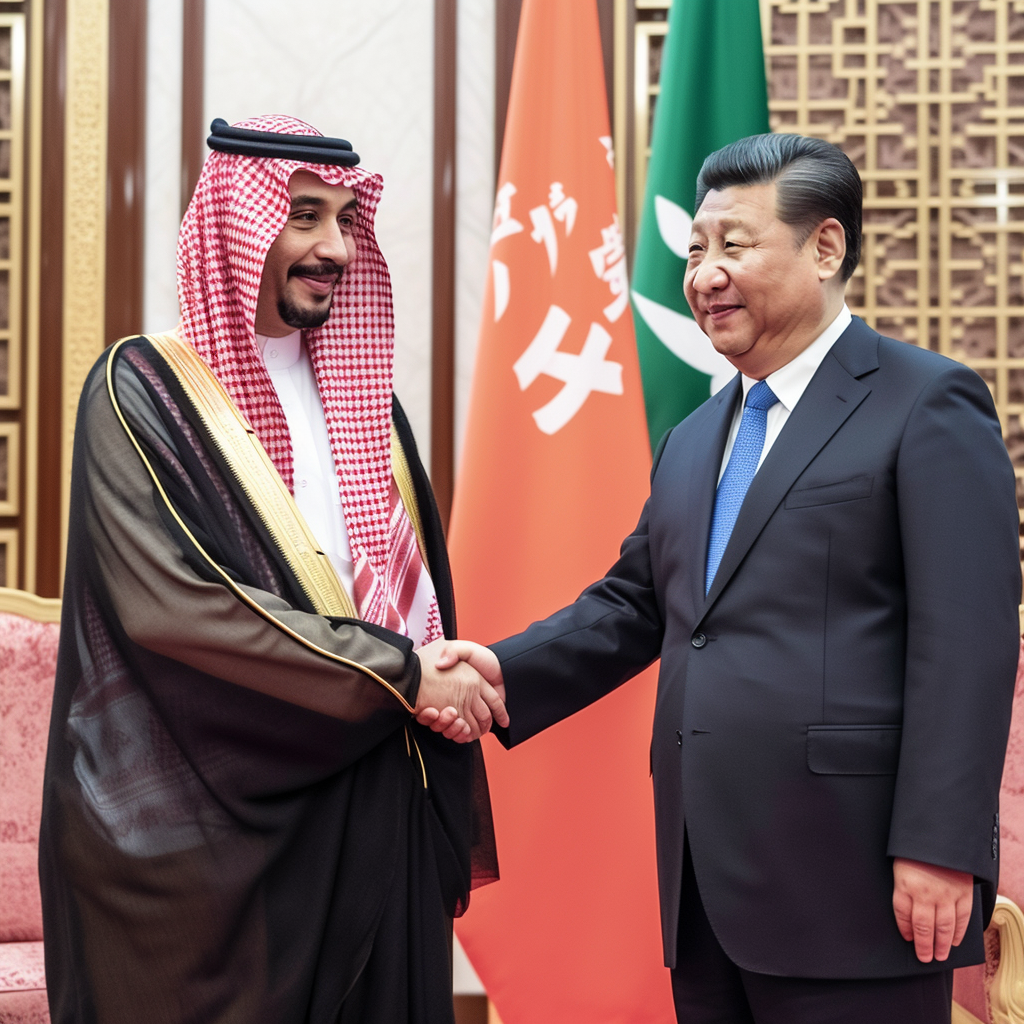

As tensions between Saudi Arabia and the United States continue to rise, the potential implications for the global economy and energy markets cannot be overstated. The recent announcement by Saudi Arabia that it will accept the Chinese Yuan for settling international oil contracts has the potential to shake the very foundation of the global financial system, particularly the Petro-Dollar system that has been in place since the early 1970s.

Implications of Saudi Arabia’s Shift

The Petro-Dollar system, which essentially requires all international oil transactions to be settled in U.S. dollars, has been a cornerstone of American foreign policy and economic dominance for decades. However, as Saudi Arabia, one of the largest oil-producing nations in the world, begins to shift away from this system, the implications for the U.S. economy and oil industry could be significant.

This shift towards the Chinese Yuan could potentially lead to a decrease in the value of the U.S. dollar and increased inflation. Furthermore, the potential for increased tensions between the U.S. and Saudi Arabia could have negative consequences for the global economy as a whole.

Opportunities for American Oil Production

At the same time, this shift towards the Chinese Yuan could present a unique opportunity for American oil production. As the U.S. dollar loses its dominance in the international oil market, American oil producers may be able to compete more effectively on the global stage. With the potential for increased demand for U.S. oil, there may be opportunities for savvy investors to take advantage of this shift in the market.

American oil producers may also benefit from the fact that the Chinese government has been seeking to diversify its oil sources, including increasing imports from the United States. This could further boost the demand for U.S. oil and create new opportunities for American producers.

Investment Opportunities for American Investors

The shift towards the Chinese Yuan also presents potential investment opportunities for American investors. While the move by Saudi Arabia to accept the Chinese Yuan for settling international oil contracts may seem like a negative development for American energy production, there are ways that investors can benefit from this shift.

One opportunity is to invest in American oil production companies. As the U.S. dollar loses its dominance in the international oil market, American oil producers may be able to compete more effectively on the global stage. With the potential for increased demand for U.S. oil, there may be opportunities for investors to take advantage of this shift in the market.

Another opportunity for investors is to take advantage of fluctuations in the currency markets. As the market adjusts to the shift towards the Chinese Yuan, there may be opportunities for investors to make gains by buying or selling currencies at the right time.

Furthermore, as the global financial landscape continues to evolve, it will be important for investors to stay informed and vigilant in order to take advantage of these opportunities. This requires an understanding of the complex factors driving the global energy markets, including geopolitical tensions, technological innovations, and shifting consumer demand.

At Main Oak Capital, we are committed to staying ahead of these trends and identifying opportunities for our clients. With our deep knowledge and expertise in the energy sector, we are well-positioned to help investors take advantage of the shifting global landscape. We offer a range of investment options, including direct investments in energy companies, as well as managed portfolios that seek to optimize returns in a rapidly changing market.

If you are interested in learning more about potential investment opportunities in the energy sector, we encourage you to reach out to us today. We can help you navigate the changing financial landscape and identify opportunities that are right for you.

Main Oak Capital: Your Partner for Energy Investments

Despite the potential risks, there is no doubt that the shift towards the Chinese Yuan has the potential to create significant oil and gas investment opportunities for American oil production and investors. At Main Oak Capital, we are constantly monitoring the global financial markets and seeking out opportunities for our clients.

With our deep knowledge and expertise in the energy sector, we are well-positioned to help investors take advantage of the shifting global landscape. If you are interested in learning more about potential investment opportunities in the energy sector, we encourage you to reach out to us today. We can help you navigate the changing financial landscape and identify opportunities that are right for you. Fill out our contact form or feel free to call us directly at (972) 433-6001 to speak with someone about what is right for you!